The day before Thanksgiving nine years ago, Karen Arndt went to the pharmacy after being diagnosed with diabetes.

In that single trip, she shelled out $425 for medications, including insulin, and for supplies used to treat the disease.

“I thought, ‘Now what am I going to eat?’” she said. “So I went and got a Healthy Choice frozen turkey dinner. I came home and I sat in my chair with all my medications and my turkey dinner, and I bawled my eyes out.”

Since then, Arndt and many diabetes patients like her are finding themselves even more financially strapped by the dramatic rise in insulin costs.

Over the past decade, the prices of several insulin drugs have jumped 300 to 500 percent.

All three major insulin manufacturers in the U.S. have increased their prices.

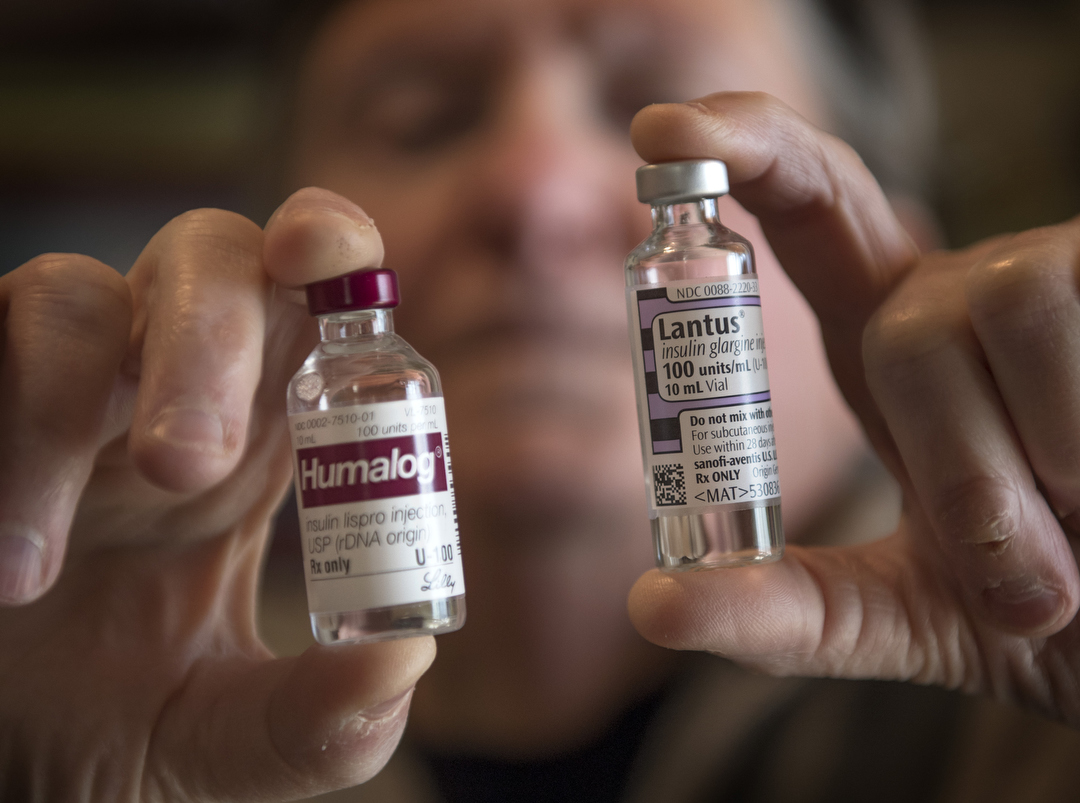

Since 2004, Novo Nordisk’s insulin Novolog is up 381 percent, Eli Lilly’s Humalog is up 380 percent and Sanofi’s Lantus is up 400 percent, according to an NBC News report using data from Truven Health Analytics.

This leaves patients like Arndt, who would die without insulin, feeling the pain of trips to the pharmacy.

And it’s leaving doctors like Gregory Deines, DO, feeling stretched as they strive to care for patients who have diabetes. Dr. Deines is a Spectrum Health Medical Group diabetologist.

Supply and demand

The topic of insulin cost comes up a lot during office visits, said Dr. Deines, who specializes in endocrinology and metabolism.

“Every day, at least 20 times a day, with every single patient,” he said. “That is absolutely a problem. We have to spend a lot of time looking to see, ‘What does their insurance cover? What benefits are available? What possible discounts are there from the drug manufacturer?”

His office provides a multidisciplinary team with nurses and a care coordinator to help patients navigate the costs.

About 30 million Americans—or just under 10 percent of the population—have diabetes. Of these, about 1.25 million children and adults have Type 1 diabetes, in which the body does not produce insulin. The rest have Type 2 diabetes, in which the body does not use insulin properly, causing insulin resistance. Initially, the pancreas may compensate by making extra insulin, but it eventually fails to make enough to maintain blood glucose levels.

Plenty of treatment options are available for patients with Type 2 diabetes, including oral medications that cost little or nothing, Dr. Deines said. He urges Type 2 diabetes patients to talk with their doctor and pharmacist to ensure they’re on the most cost-effective medication program.

For Type 1 diabetes, previously known as juvenile diabetes, there are no other options.

“The only thing that keeps you alive is insulin,” Dr. Deines said.

The question of why insulin costs have skyrocketed is a complicated one.

“I think it’s a combination of factors,” the doctor said. “It’s a combination of research and development costs, but also supply and demand for the insulin.

“Pharmaceutical companies have developed a product that, for people with Type 1 diabetes, is a life or death medication,” he said. “People don’t really have a choice whether or not to purchase the drug. Depending on how you use that concept as a manufacturer, you can really drive up prices.”

More people are now aware of a trend that has been building for years because of the prevalence of high-deductible health savings account health insurance plans, Dr. Deines said. These have put consumers in tune with the real costs of medications and medical services.

“If your copay was $10, you didn’t realize what was happening in drug prices,” he said.

Market factors

Another factor: There’s no generic version of insulin.

“So, imagine you have a health plan that charges different copays for a generic and brand name, and the brand name may be four or five times higher,” Dr. Deines said. “You’re not saying that you don’t want the generic. There is no generic.”

Dr. Deines points to another critical moment in history that brings us to where we are today.

In 1921, the researchers who invented insulin debated about whether to patent the drug, knowing it would be a lifesaving solution with huge implications for those with a diabetes diagnosis. In the end, they decided to file a patent, which they sold to The University of Toronto for $3—or $1 for each of the researchers listed.

“They thought that the university would do the right thing and allow it to be distributed to everyone for a reasonable price,” Dr. Deines said.

For many years that had been the case. Patients could get a vile of insulin for 84 cents, Dr. Deines said.

But then things changed.

“The market drove it, like with everything in health care,” he said. “The markets did what they did.”

Dr. Deines has several patients who drive across the border to buy insulin in Canada, where they can get the exact same thing for much less. He’s hoping public awareness and outcry will help, as it did in the case of EpiPens late last year.

Following heightened media attention and public uproar over sky-high prices, the EpiPens issue made its way to the House Committee on Oversight and Government Reform. Now, a cheaper generic version is available for another life-saving medication.

“What I advise people do is know your insurance plan,” Dr. Deines said. “Understand your benefits.”

After the insurance companies updated their drug formularies in January, he urged patients to research any changes and find out if any coupon discounts are available. He also told patients to shop around at different pharmacies to find the best price.

Consumers should talk with their pharmacist to be sure they’re getting the lowest possible price on medication.

“If something doesn’t seem right—if it seems like you’re paying too much money—double-check with your doctor to see if there’s a better covered alternative,” he said.

‘Very scary’

Arndt is familiar with all of this. With diabetes and heart problems, it can be overwhelming to manage prescriptions and doctor visits.

Doctors diagnosed Arndt with Type 2 diabetes nine years ago.

Although she has tried other medications, she now relies on two insulins. Under her Medicare Part D prescription drug plan, her prescriptions are covered at a higher rate until she reaches the coverage gap, commonly known as the “doughnut hole.” While she’s in this coverage gap, she pays higher costs for her insulin and other medications. In this stage, she pays around $125 per month for each of her insulins.

“If you have any savings, it’s not for a beautiful trip, it’s for a trip to the pharmacy,” she said. “I’m the kind of person who just picks myself up and dusts myself off. But it gets harder and harder to do that.”

She praises Dr. Deines’ office and Priority Health, her insurance carrier, for helping her manage her medications. A nurse from Priority Health calls her monthly to check in. Arndt always writes down her questions in anticipation of the call.

She’s hesitant, however, to accept free samples of medication from Dr. Deines’ office.

“I’m not going to take it away from someone who doesn’t have what I have,” she said. “I don’t have millions of dollars, but somebody around the corner could have a lot less.”

She’s also skeptical of the pharmaceutical companies’ price hikes, seemingly for the same product.

“You want them to come to your house and sit there,” Arndt said. “I would probably put them in the corner. You want them to see you are not eating filet mignon.

“It’s very scary,” she said.

/a>

/a>

/a>

/a>

/a>

/a>

What the drug companies are doing is truly appalling and unjustifiable. A suggestion for a follow up article is, what is being done to fight this and how we can get involved?

I’m a 100% device connect disabled vet!

Unfortunately although I’m suppose to be able to get my meds free from the VA…the issue is that the big and ponderous VA health care system is “light years,” behind in newer medical reasearched treatments and particularly Pharmaceuticals!!!

The insulin my “civilian doctor” has found works for me…is called Treseba. The price of which just keeps climbing into the stratosphere!!! The greedy manufactures and lack of government support for the wellfare if it’s Vets and citizens alike is so demoralizing and financially devistrating!!! Those fat cats in Washington through the House oversite committees took on the Pharmaceutical industry over epiPen‘s and cheaper generics are now available. Why do people who are insulin dependent, have to go broke and make decisions between food/heat to purchase their insulin at ever increasing rates

ir die from a treatable/controllable disease???

Apparently, those fat cats in a Washington just don’t care…they have voted themselves a healthcare plan that no nonmember of Congress could ever hope to have or pay for!

Is it time for a revolt at the ballot box??? These current members of Congress, certainly have shown their lack of concern for the rest of us and have given themselves instead perks, way above everyone else!

I thought the Revolutionary War was fought to end the injustices of monarchy and parliament? But some have set themselves up as the “new royalty” in our beloved country, for whom we took an oath to defend and protect! Where’s the reciprocity???

We’ve got to band together to vote the bums out…because, “surely either we must stand (hang) together, or shurely we will hang separately!”

I think the cost of insulin is outreagous. My husband used 2 kinds and costs us over $1000 every 3-4 months per insulin. Were not rich but it takes a big chunk of any savings we have.